Wills Trusts & Administration Fees

HONEST, EFFECTIVE & AFFORDABLE

WILLS & ESTATES LEGAL HELP

WILLS, ADVANCE MEDICAL DIRECTIVES and POWERS OF ATTORNEY

If you want us to draft a will, a trust, a power of attorney and/or an advance medical directive the following sets forth our fees.

2 Situations: 2 Types of Fees

SITUATION ONE: NO TAX PLANNING: This is for clients who are not likely to be in danger of paying any federal estate tax. Right now single clients with estates of that are highly likely to be less than $11 million ($22 million for married clients) we can do a simple will with no real need to come up with an estate plan to eliminate and/or reduce estate taxes. Here we do not do an intense review of the clients assets and liabilities and pretty much accept the clients’ direction as to what they want in their will etc. Here the client gives tells us who gets what gifts, who they want their executor to be and who they want to make medical decisions for them if they are incapacitated. Here there are really no significant legal issues to be researched or worked out. These types of cases are almost always handled under our PROTECTED FLAT FEE PROGRAM (see the Flat Fee page of our website for terms and conditions). Under this program the typical fees are as follows:

Simple Will $ 140, Spouse Will $110 extra

Advance Medical Directive $90 Spouse Medical Directive $90 extra

Power of Attorney $90 Spouse Power of Attorney $90

SITUATION TWO: Larger estates that require tax planning to reduce or eliminate possible federal estate taxes are quoted on an estimated flat fee on a case by case basis. That fee, however, is also calculated in a manner consistent with the Protected Flat Fee Program noted above. (See the Flat Fee page of our website for terms and conditions)

Please see the bottom of this page if you are an executor, administrator and/or trustee or if a loved one has recently passed and you are seeking help in administering the estate or a trust.

TO CHAT NOW

please TEXT 804.300.9086.

To set an appointment

please call

804.935.8549 or 804.549.7240

or you can do it yourself at

“Set Up Appointment” page on this site.

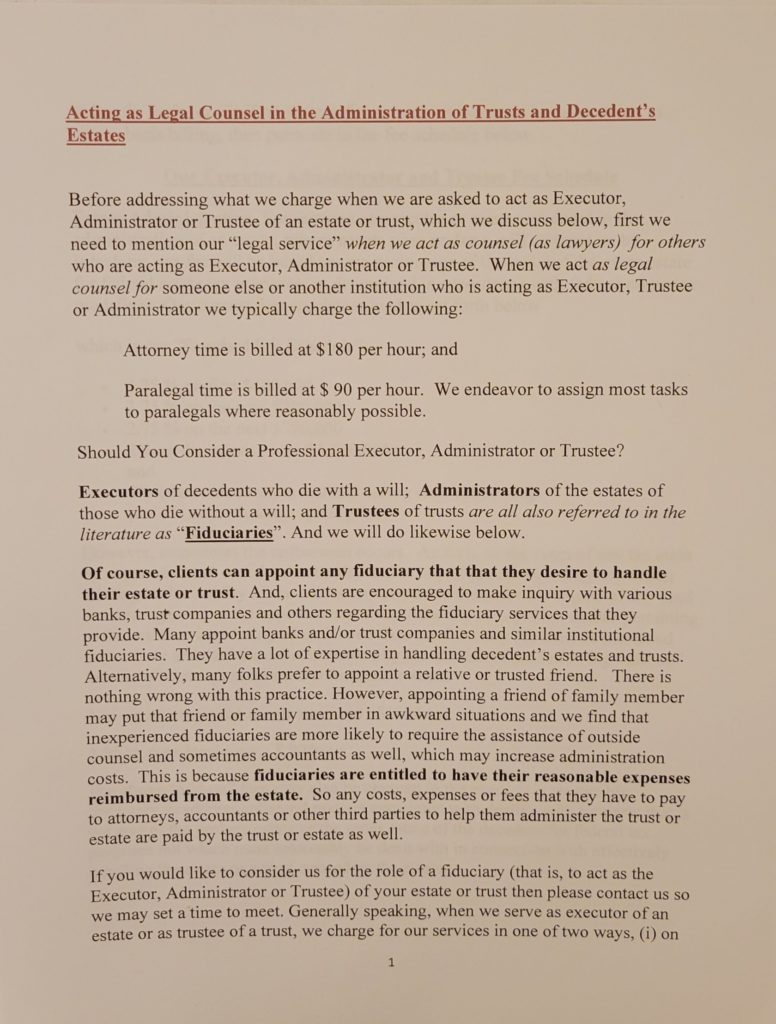

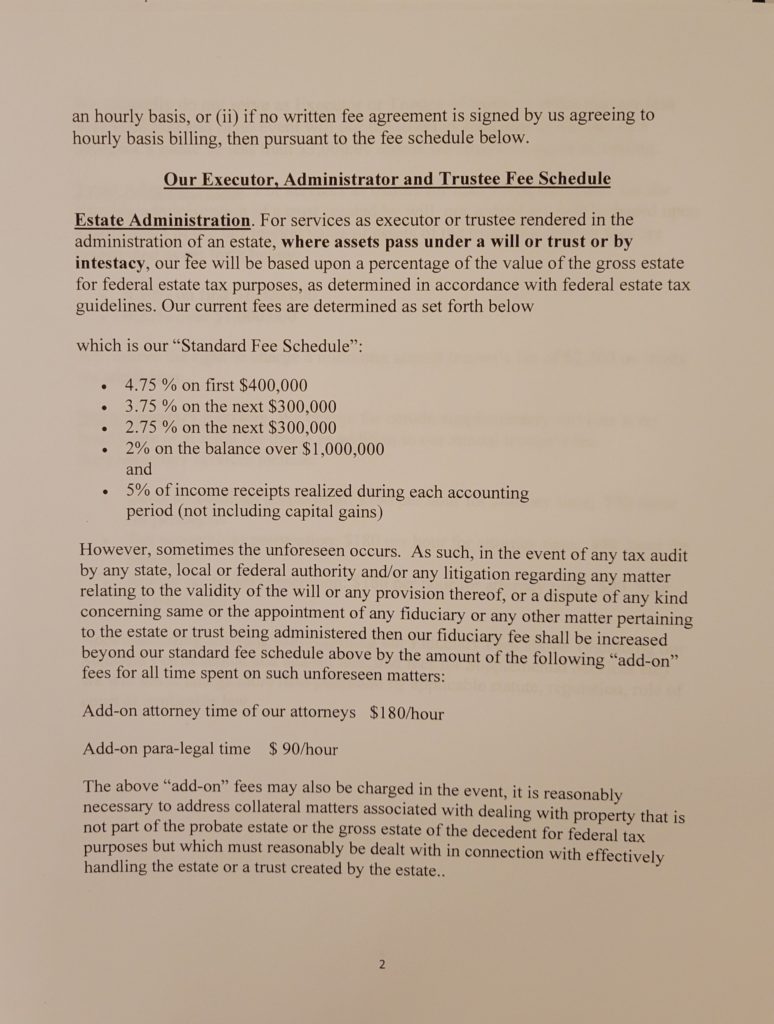

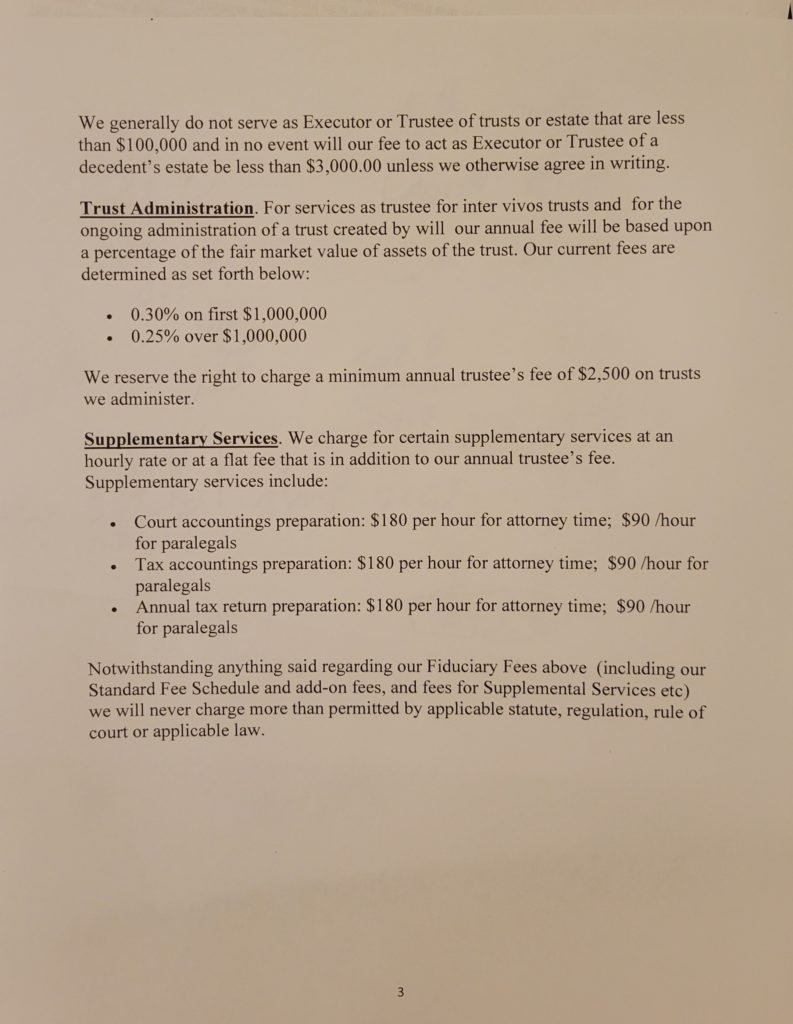

ESTATE AND TRUST ADMINISTRATION FEES

The information below states what our fees are regarding estate and/or trust ADMINISTRATION. As such, the FEES BELOW ON THIS WEBPAGE are INCURRED ONLY IF:

(i) we are hired (in one of the capacities set forth on this page) AFTER a decedent dies and his/her will (which was previously signed and witnessed) is being administered by an “Executor, or in the case of someone who dies without a will, his or her estate is being administered by the decedent’s “Administrator”; OR

(ii) we are hired (in one of the capacities set forth on this page) when an EXISTING trust ( a trust already in existence) is being administered by a trustee. These trusts may have been either created in a now decedent’s will OR at some time in the past during the lifetime of the trust’s creator.